Another reform? Proposals for the post-2013 Common Agricultural Policy

Summary

Following two decades of policy change, in 2011 the European Commission tabled proposals for a new ‘reform’ of the CAP.

A major component of the reform would be a revamping of the existing system of direct payments to farmers.

For example, 30% of the spend would be dependent on farmers respecting new greening criteria; and payments would be restricted to active farmers and subject to a payment cap.

These proposals will be debated by the Council of Ministers and the European Parliament throughout 2012, and possibly 2013, before final decisions are reached.

What aspects, if any, of the proposals will prove acceptable is yet to be discerned.

Although tabled as part of a financial package, the proposals do not appear to be driven by financial exigency: indeed they seek to maintain the expenditure status quo.

Nor do they appear to be driven by international pressures: if anything, they backtrack on previous attempts to bring the CAP into conformity with a post-Doha WTO Agreement on Agriculture.

Instead they seek to establish a new partnership between society and ‘farmers, who keep rural areas alive, who are in contact with the ecosystems and who produce the food we eat’ (Ciolo? 2011), in an attempt to justify continuing support.

Key words: agriculture, CAP, Doha, EU, reform, WTO

Glossary

Agreement on Agriculture: one of the trade agreements negotiated during the Uruguay Round (see below) and now administered by the WTO. It imposes three sets of disciplines on farm policies, relating to market access, export competition and domestic support (WTO 1994; Daugbjerg & Swinbank 2009). Domestic support is further differentiation between the so-called amber, blue and green boxes (see below).

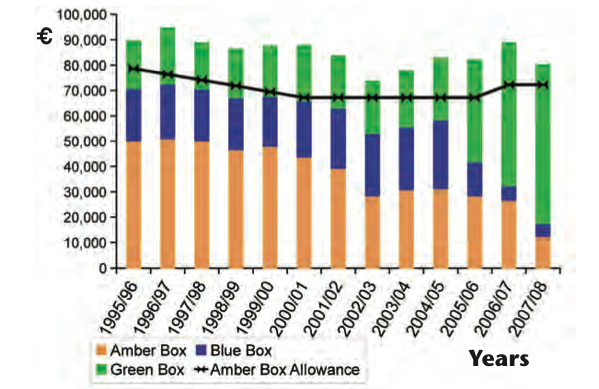

Amber, Blue and Green Boxes: The provisions of the WTO’s Agreement on Agriculture relating to domestic farm support are complex, but the basic idea is that all domestic farm support has to be allocated to one of three categories. Expenditure on programmes that have no, or very little, impact on production, and consequently on trade, are said to be decoupled and fit within the so- called green box. This includes direct payments to farmers that are not linked to current input use, prices, or production. There are no expenditure limits on green box support. All other support for farmers (apart from that allotted to an intermediate category, the blue box) falls by default into the amber box. Amber box support is subject to agreed limits (for the EU this is shown as the ‘Amber Box Allowance’ in Figure 1). The proposal on the table in the Doha Round is for a 70% cut in the EU’s Amber Box allowance. The blue box houses expenditure on partially decoupled support, such as area payments based on a fixed area and yield, and headage payments payable on a fixed number of livestock. Currently there are no limits on blue box expenditure, but there would be if the Doha Round were to be concluded. Blue box: see Amber, Blue and Green Boxes.

Decoupling: breaking the link between support to farmers and their production decisions (inputs used, quantities produced).

Doha Round: a multilateral trade negotiation under the auspices of the WTO, launched in 2001 but as yet unfinished.

European Union: Today’s EU of 27 Member States has evolved from the initial European Economic Community (EEC), of six, established in the 1950s. A succession of treaty changes have enlarged its scope and changed its decision-making procedures to allow for increased use of qualified majority voting in the Council of Ministers, and a growing role for the European Parliament. Seventeen of the 27 have a common currency: the euro. Throughout the EEC/EU’s history the CAP, the budget, and monetary union have been the focus of sharp disagreements between the Member States. In December 2011 the Eurozone countries, and some other Member States, in response to concerns about the future of the euro, embarked on a programme of negotiations that might lead to closer macroeconomic coordination of their economies. The EU has three core institutions that jointly determine policies: the European Commission, the Council of Ministers, and the European Parliament. The Heads of State or of Government operate as a ‘super’ council – the European Council – to provide overall guidance.

Green Box: see Amber, Blue and Green Boxes.

Greening the CAP: making European agriculture more environmentally friendly.

Pillars 1 and 2 of the CAP: Pillar 1 refers to a series of CAP policy measures that support market prices and farm incomes. Pillar 2 refers to measures undertaken under the Rural Development Regulation.

Treaty of Lisbon: the latest EU Treaty, which came into force in December 2009, has considerably enhanced the European Parliament’s role in CAP decision-making.

Uruguay Round: a multilateral trade negotiation under the auspices of GATT, which lasted from 1986 to 1994 and led to the creation of a new trade regime under which the WTO administers a number of trade agreements, including the Agreement on Agriculture (see above) and a re-enacted GATT.

Abbreviations CAP Common Agricultural Policy; EEC European Economic Community, now the EU; EU European Union; GATT General Agreement on Tariffs and Trade; Mercosur Mercado Común del Sur; MFF Multiannual Financial Framework; OECD Organisation for Economic Co-operation and Development; SPS Single Payment Scheme; UK United Kingdom; WTO World Trade Organization

Introduction

Two Decades of CAP ‘Reforms’

From the early-1960s until 1992 the fundamental framework of the CAP went largely unchanged, with the introduction of milk quotas in 1984 perhaps the most significant exception.

Following those ‘thirty years of immobility’ (Garzon 2006), the last twenty years have brought a succession of changes (Cunha with Swinbank 2011) that mean that the CAP’s policy mechanisms – if not its objectives – at the beginning of the 2010s are different from those of the early 1990s.

In 1991, launching what was later to be dubbed the MacSharry Reform, the European Commission said of the CAP—‘created at a time when Europe was in deficit for most food products’—that its system of market-price support had led ‘to a costly build up of stocks’; to the EU ‘having to export more and more on to a stagnant world market’ which ‘goes some way towards explaining the tensions between the [EU] and its trading partners’; and that it encouraged ‘intensification of production techniques’ which ‘if unchecked, leads to negative results. ... nature is abused, water is polluted, and the land impoverished’ (Commission of the European Communities 1991).

Those three themes—the CAP’s cost; pressure from the EU’s trading partners; and a growing concern about agriculture, land use and the environment—have been cited by a number of scholars to explain the pressures that have been brought to bear on policy-makers, and the subsequent sequence of CAP ‘reforms’ (Daugbjerg & Swinbank 2011).

In brief, that sequence has been as follows.

The 1992 ‘reforms’, named after the then EU farm commissioner Ray MacSharry, reduced the support (intervention) prices for cereals and beef, whilst compensating farmers for the implied revenue loss through area and headage payments, based on the area of eligible crops grown and the number of beef animals and sheep kept.

This, far from coincidently, came at a time when the Uruguay Round (1986-1994) of multilateral trade negotiations under the auspices of GATT was stalled.

The changes allowed the Round to be concluded, and the creation of a new trade regime administered by the WTO. Although the reform increased the taxpayer cost of the CAP (by shouldering support that consumers had borne through higher prices), the budget cost of the post-1992 CAP was more predictable and, because of limits on the number of hectares and animals that would be supported, less prone to rampant growth.

The CAP’s barely-developed structural component was slightly strengthened: Garzon (2006) suggesting that the ‘main innovation was the introduction of agri- environmental measures at EU level.’

Previously some Member States had developed such schemes. Now all were required to do so.

The Agenda 2000 package (agreed in Berlin in March 1999) deepened the reforms of the cereals and beef regimes, and introduced the so-called Pillar 2 of the CAP (Rural Development) by repackaging existing measures for structural change, environment protection, and predominantly farm-based rural development, but without the level of funding that the then farm Commissioner, Franz Fischler, had sought (Serger 2001). His second attempt at reform, in 2003, was both more ambitious and successful.

The 1992 reform had started the process of decoupling (breaking the link between production and support) as advocated by the EU’s trading partners in GATT and the OECD. In particular it broke the link with yields, although crops still had to be sown, and animals kept, for payments to be made. The Fischler reforms went further by replacing the area and headage payments, and some others, by the Single Payment Scheme (SPS).

The basic design of the SPS, although there were some important exceptions, was that of an annual payment to farmers, linked to land holdings but otherwise decoupled from production, and subject to some environmental conditions (known as ‘cross compliance’) (Swinbank & Daugbjerg 2006). Decoupling of support for milk producers also began, although quotas remained an important part of the dairy regime.

The Fischler reform was settled at a potentially important stage in the Doha Round of multilateral trade negotiations. As with the MacSharry reform during the Uruguay Round, the links between the two processes were important (Daugbjerg & Swinbank, 2009), but an agreement in the WTO was, and remains, illusive.

Under Fischler’s successor, Marian Fischer Boel, the decoupling agenda was extended to most other CAP products, including sugar, so that by the early 2010s the bulk of EU budget expenditure on the CAP was spent on direct payments.

Thus the European Commission’s initial draft budget for 2012 allocated ?40.7 billion for direct payments, €3.1 billion for market price support and other intervention, and €12.7 billion to Pillar 2 (Rural Development). (Appropriations for payments in Budget headings 05.03, 05.02 and 05.04 respectively (European Commission 2011a)).

The relative decline in the importance of the ‘old’ CAP of market price support brought about by two decades of policy change has been accentuated by more buoyant world commodity prices. The EU’s high import taxes on farm and food products remain, however, and will only be reduced following a Doha settlement.

Moreover, when world dairy prices plunged in 2009, intervention buying and export subsidies were reactivated, but then again removed when world prices recovered. Apart from private storage of olive oil (Agra Facts 2011b) the ‘old’ CAP market price support mechanisms are currently (January 2012) in abeyance, although still on the statute books.

Reflecting these structural changes in the budget spend on the CAP, the EU’s annual declarations of domestic farm support to the WTO, as can be seen in Figure 1, show a clear movement away from trade-distorting amber box support (subject to WTO limits) to the so called green box, which includes policies with only a minimal impact on trade and which is consequently not subject to WTO spending limits.

This shifting of support between boxes has been viewed with suspicion by some of the EU’s trading partners, particularly those harbouring the view that the ‘colour’ of the support is less important than its overall size.

Why 2013? The EU has had a rolling programme of financial planning since the 1980s. Although an annual budget is determined, this is in the context of a Multiannual Financial Framework (MFF) that specifies annual budget ceilings.

At the time of writing we are approaching the end of the 2007- 2013 MFF, and accordingly in June 2011 the European Commission presented its proposal for the 2014- 2020 MFF.

The proposed budget limits for the CAP were then incorporated into its subsequent proposals for the post-2013 CAP (European Commission 2011b and 2011c; Matthews 2011). Following ratification of the Treaty of Lisbon, which came into force in December 2009, the European Parliament has an increased role in CAP decision-making (Greer & Hind 2011).

Consequently prolonged discussions between the Member States (in the Council of Ministers, and perhaps in the European Council) and between the institutions (Parliament,

Council and Commission), are expected. It is possible these will extend through the next four Presidencies of the Council of Ministers (Denmark, followed by Cyprus in 2012; Ireland, followed by Lithuania in 2013) to a last minute decision in late 2013.

Not only have the decision-making procedure s changed since the last CAP reform, but the EU is now embroiled in a severe financial crisis in which the very survival of the euro seems threatened, with one Member State (the UK) distancing itself from the December 2011 decisions taken by the rest.

(The British Prime Minister’s opening comment to the House of Commons was that he had gone to the European Council ‘with one objective: to protect Britain’s national interest’ (Cameron 2011)). Quite how this will affect discussions on the 2014-2020 MFF, including the touchy issue of the British rebate (more below), and on the post-2013 CAP, remains to be seen.

As explained by the European Commission in a leaked, and unadopted, draft document:

‘The UK correction was introduced when more than 70% of the EU budget was spent on agricultural market measures. At the time, the United Kingdom was one of the least prosperous Member States. ... Today the UK is one of the most prosperous Member States and the share of ... agricultural expenditure in the EU budget has decreased significantly’ (European Commission 2009).

Although some other Member States also benefit from special rules, the British rebate, worth several billion euros a year, is by far the most important.

It was first negotiated at the Fontainebleau meeting of the European Council in 1984, and has been renewed, more-or-less intact, in subsequent MFFs. It will be, presumably, a major element in the UK’s negotiating objectives for the 2014-2020 MFF.

In 2005, when the Member States were negotiating the 2007-2013 MFF, it was suggested that the UK would be willing to surrender part of its rebate if France were to agree to CAP reform (Begg and Heinemann 2006).

In the end there was stalemate, but the UK did believe that it had been agreed that the Commission would ‘undertake a full, wide-ranging review covering all aspects of EU spending, including the Common Agricultural Policy, and of resources, including the United Kingdom rebate, and ... report in 2008/09.’ (European Parliament, Council and Commission 2006).

Despite a major consultation exercise implemented by the European Commission, and the leaking of the document referred to above, nothing emerged from this process until 2010.

The Proposal

There are perhaps three key features of the European Commission’s proposals for the post-2013 CAP that should be emphasised.

First, despite the complexity (indeed opacity) of the documentation, this is not a proposal for radical reform. It has nothing comparable to the decoupling of the MacSharry (area and headage payments) or Fischler (the SPS) reforms.

Second, budget expenditure on the CAP, and its allocation to direct payments, market price support, and rural development, is set to remain more-or-less unchanged through to 2020 in current (money) terms, although this implies a reduction in real terms and as a percentage of the EU budget spend.

Third, there would be new environmental constraints put upon 30% of expenditure under the SPS’s successor scheme.

Milk and sugar quotas will end. The Rural Development Regulation (Pillar 2 of the CAP) would be revised, but no additional funding would be made available. Moreover, as yet, how Pillar 2 funding will be distributed among the Member States remains unclear.

It is perhaps surprising that the European Commission is proposing no change in either Pillar 1 (income and market price support) or Pillar 2 (rural development) funding from that achieved in the last year of the 2007- 2013 MFF, despite widespread belief that funding should switch from Pillar 1 to Pillar 2, and rival bids for scarce government funds.

It would appear that it is seen to be too political to challenge the status quo. Whether there is a Plan B remains to be seen. If finance ministers impose a tight financial settlement on the CAP, will it be rural development (Pillar 2) that bears the brunt of the cuts, as happened in the two preceding MFFs (2000-2006, and 2007-2013), or Pillar 1 (i.e. direct payments)?

Direct Payments

It is proposed that the existing SPS (and its parallel arrangements in the Member States that joined the EU in 2004 and 2007) be replaced by a new, legally distinct, regime in 2014; but one that clearly displays its origins.

As explained earlier, the 1992 reforms introduced area and headage payments to compensate farmers for the implied loss in revenue stemming from reductions in support prices. A decade later it seemed both inappropriate and politically problematic to continue with this terminology.

How could compensation still be justified in the old Member States; or for that matter in the ten new states that were about to enter the EU and had not experienced the 1992 reform? Consequently, in 2003, the SPS was referred to as ‘an income support for farmers’; even though it was never clearly explained why farmers collectively needed ‘income support’, or how the actual distribution of payments between farmers or countries could be justified (Swinbank, 2011a).

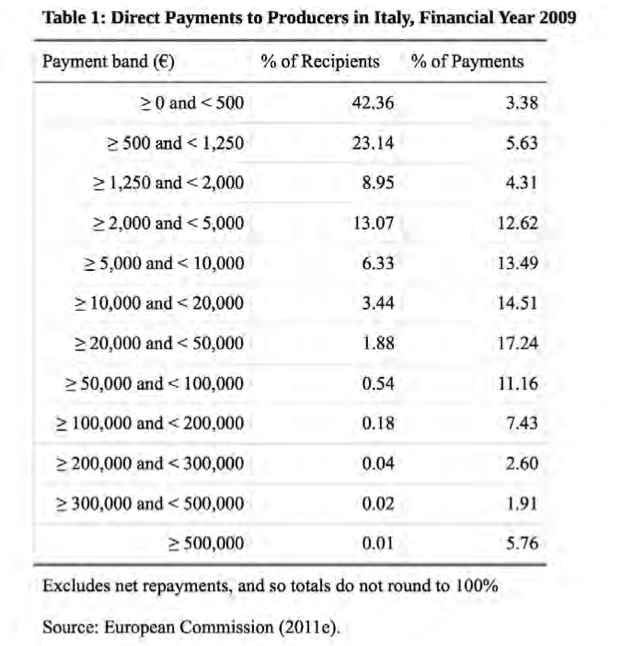

Within Member States payments are highly skewed, reflecting past production rather than any objective measure of current need for income support. In Italy, a rather extreme case, 42.4% of claimants, for example, received €500 or less, accounting for 3.4% of monies paid out, whereas at the other end of the scale a mere 0.8% of claimants claimed €50k or more and scooped 28.9% of the cash, as can be seen in Table 1.

One particular complaint has been that the new Member States (and some old ones, such as Portugal) had been allocated a rather low budget for direct payments.

Even after their phased introduction they amounted to about €100 per hectare in Latvia, for example, compared to well over €400 in The Netherlands (European Commission 2011d). Consequently the European Commission has proposed some narrowing of the gap whilst keeping the overall €27 spend within budget.

Increased equity within Member States is to be achieved by insisting on a move to regionalised payments (with a common payment per hectare for all farmers within the region), compared to the historic model that some Member States had continued to apply.

Under the latter per hectare payments could differ between neighbouring farmers, depending on their past production patterns.

Although the explanatory memorandum to the proposed Regulation does mention the need for income support, the draft Regulation itself does not. Article 1 establishes ‘a basic payment for farmers’, which it calls ‘the basic payment scheme’, together with a payment for farmers observing agricultural practises beneficial for the climate and the environment (European Commission 2011c).

Farm businesses already in receipt of direct payments will be allocated entitlements under the basic payment scheme; with 30% of a Member State’s budgetary allocation for direct payments earmarked for the greening component.

This, nominally, leaves 70% of the funds for the basic payment scheme, but there are other calls on this money (for young farmers and disadvantaged regions for example), and more scope for coupling support to specific crops than is the case under the current regime.

The greening component will be paid in addition to the basic payment (although whether the basic payment is payable without compliance with the greening component was unclear in the original English text).

The basic payment, after allowing for the cost of employed labour, would be subject to ‘progressive reduction and capping’. Payments in excess of €150k per annum would be subject to ‘progressive reduction’; in effect an escalating tax rate reaching 100% at €300k, imposing a cap of €235k on a farm business’ basic payment receipt (European Commission 2011c).

Greening, Active Farmers, and the WTO’s Green Box

The greening payment for non-organic arable farmers would be dependent upon them planting three different arable crops, none of which could occupy less than 5% or more than 70% of their arable area; maintaining existing permanent grassland; and keeping at least 7% of their eligible hectares as an ecological focus area, such as ‘land left fallow, terraces, landscape features, buffer strips and afforested areas’ (European Commission 2011c).

These constraints on production make it very difficult to justify the claim that these would be green box payments.

They appear to infringe paragraph 6(b) of Annex 2 of the Agreement on Agriculture (WTO 1994) that insists that ‘decoupled income support’ and ‘direct payments to producers’ (paragraph 5) should ‘not be related to, or based on, the type or volume of production ... undertaken by the producer in any year after the base period’; and 6(d) which insists that payments ‘shall not be related to, or based on, the factors of production employed in any year after the base period’ (which is a problem too for the existing SPS, as both involve an annual claim based on the land at a farmer’s disposal).

Nor could the greening payment be readily justified as ‘payments under environmental programmes’ (paragraph 12 of the green box) as these are to be ‘limited to the extra costs or loss of income involved in complying with the government programme’; and there is no such provision.

The attempt to restrict the basic payment to active farmers is also problematic. As the European Commission’s explanatory memorandum explains: ‘the definition of active farmer further enhances targeting on farmers genuinely engaged in agricultural activities, and thus legitimizes support’.

The EU is trying to ensure that entities such as aerodromes or golf courses, that happen to have some agricultural land attached to their business, do not qualify for CAP support.

Article 9 of the draft Regulation is carefully crafted so that it excludes certain groups (e.g. when ‘the annual amount of direct payments is less than 5% of the total receipts they obtained from non- agricultural activities in the most recent fiscal year’, which would probably exclude quite legitimate farming activities such as university farms), rather than specifying what businesses have to do to be considered active farmers.

As the European Commission’s Impact Assessment (2011d) concedes: ‘Many of the criteria that could be used to define who is an “active farmer” could be problematic from a WTO point of view ... in particular they cannot imply an obligation to produce.’

Whether or not the proposed scheme of direct payments, with its greening component and restriction to active farmers, or for that matter the existing SPS, is green box compatible is, for the moment, of only esoteric importance, for if not green then these are either amber or blue box payments.

As shown by Figure 1, the existing amber box support falls well short of WTO allowances, and these contested payments could be rehoused there, or in the blue box for which there is no current constraint.

Thus, for the moment, the EU is unlikely to be challenged in the WTO’s Dispute Settlement Body. If, however, the Doha Round were to be concluded, with a 70% cut in the EU’s amber box allowance, and new constraints on the blue box, then the green box compatibility of the post- 2013 CAP’s direct payments would become of critical importance.

If the green box classification of these direct payments were to be disallowed by the WTO, this would mean that a key component of the post-2013 CAP directly contravenes the EU’s international commitments.

Implications for World Agriculture

The proposals for the post-2013 CAP are unlikely to have a major impact on world trade in farm products, and hence upon world agriculture.

The greening of direct payments, and the 7% ecological focus areas, might lead to a slight decrease in EU farm output. The removal of quotas on milk and sugar production in 2015 will probably lead to a slight increase in output of these products.

In the case of milk, quotas were a binding constraint in 2010/11 in only five Member States, which between them accounted for 13.4% of milk quota allocated (Agra Facts 2011a).

It is in these countries, and in The Netherlands in particular, that increases in output might be expected. Under the sugar regime, over-quota sugar cannot automatically be sold onto the domestic market, despite the shortages that were appearing in 2011.

Thus over-quota sugar was being exported from the EU (within the quantitative constraints set out in WTO obligations), whilst a tendering procedure was in place for ‘exceptional imports’ into the EU (Agra Facts 2011c).

Removal of the quota constraint would allow a more rational movement of product: whether it would also result in increased output is a more open question, although Matthews (2011) concludes that it ‘could result in a substantial increase in production’.

Other developments, post-2013, are more likely to impact world agriculture than the current CAP reform.

A successful conclusion of the Doha Round for example would open-up the EU’s market for those products still afforded high protection, such as dairy, sugar and beef. Similarly, an extension of its web of free-trade areas (permissible under WTO rules) would allow improved access for selected suppliers to the EU’s market.

The most significant of these negotiations is that with the Mercado Común del Sur (Mercosur), which comprises Argentina, Brazil, Paraguay and Uruguay, with other South American economies as Associates.

Brazil, in particular, has aspirations to sell its sugar, bioethanol, and beef, into the European market.

A study by the European Commission’s Joint Research Centre (Burrell et al. 2011) to assess the likely impact of a free-trade area with Mercosur suggests ‘that the economic losses and the adjustment pressures arising from a bilateral trade agreement between the EU and the countries of Mercosur would, as far as the EU is concerned, fall very heavily on the agricultural sector’.

Offsetting these losses for European agriculture will be gains for EU consumers, and for those overseas farmers that obtain more access to the EU market.

Conclusion

In his address to the European Parliament, launching the Commission’s proposals for the post- 2013 CAP, the present Commissioner for Agriculture and Rural Development, Dacian Ciolo (2011), said that a ‘new balance has to be established through a genuine partnership between society as a whole, which offers the financial resources through a public policy, and farmers, who keep rural areas alive, who are in contact with the ecosystems and who produce the food we eat.’

Although the proposals form part of the 2014-2020 MFF there is no indication that they are motivated by budgetary concerns, despite the Sovereign Debt crisis afflicting most EU Member States. Expenditure on both Pillar 1 and Pillar 2 would continue unchanged (although falling in real terms) through to 2020.

There would be some shifting of Pillar 1, and probably Pillar 2, support between Member States. This is not the hallmark of a real reform, but rather of business as usual; a preference for the status quo.

Whether this aspect of the proposal will survive the challenges of what is likely to be a fractious debate over the 2014-2020 MFF remains to be seen.

The Doha Round, launched in 2001, is not quite dead, although immediate prospects for its resurrection are limited. WTO Ministers, at their 8th Ministerial Meeting in December 2011, acknowledged that ‘the negotiations are at an impasse’, but once again they ‘committed to work actively, in a transparent and inclusive manner, towards a successful multilateral conclusion of the Doha Development Agenda in accordance with its mandate’ (WTO 2011).

Both the MacSharry and Fischler reforms were, in my view, strongly influenced by the on-going Uruguay and Doha Round negotiations (Daugbjerg and Swinbank 2009 and 2011).

The Fischler and subsequent reforms, together with the buoyancy of world markets, left the CAP compatible with a post-Doha Agreement on Agriculture, provided the EU’s recent declarations of amber and green box support can be robustly defended in any WTO challenge (Swinbank 2011b).

By contrast, WTO pressures do not seem to have been a key determinant for Mr. Ciolo. Indeed, the proposals on greening the CAP, on active farmers, and to allow some recoupling of support, would appear to backtrack on the success of his predecessors in acceding to the liberalising agenda of the WTO.

The key to the package is the attempt to justify to European society, ‘which offers the financial resources’, continued support to farmers, ‘who keep rural areas alive, who are in contact with the ecosystems and who produce the food we eat’.

Whether this strategy will survive the debates of the MFF, and convince finance ministers and taxpayers of the cost-effectiveness of the measures proposed (not something addressed in this paper) remains to be seen.

References

Agra Facts, (2011a). 2010/11 superlevy bill ?55.5m, with Ire, Bel & D approaching the penalty line. 81-11. 19 October 2011. Agra Facts, (2011b). Nearly 10 000t of Spanish olive oil granted PSA. 84-11. 28 October.

Agra Facts, (2011c). Green light for moves to address sugar supply concerns. 92-11. 25 November.

Begg, I Heinemann, F (2006). New Budget, Old Dilemmas. Briefing Note. London, Centre for European Reform.

Burrell, A, Ferrari, E, Gonzalez Mellado, A, Himics, M, Michalek, J, Shrestha, S, Van Doorslaer, B (2011). Potential EU-Mercosur Free Trade Agreement: Impact Assessment, Volume 1: Main results. Seville, Joint Research Centre–Institute for Prospective Technological Studies.

Cameron, D (2011). Hansard. House of Commons, 12 December, column 519. http://www.publications.parliament.uk/pa/c m201011/cmhansrd/cm111212/debtext/11 1212-0001.htm (accessed 12 January 2012)

Ciolo?, D (2011). A new partnership between Europe and its farmers. Speech presenting the legislative proposals on the reform of the Common Agricultural Policy to the European Parliament, 12 October. SPEECH/11/653. Brussels, CEC.

Commission of the European Communities (1991). The Development and Future of the CAP. Reflections Paper of the Commission. COM(91)100. Brussels: CEC.

Commission of the European Communities (2009). A Reform Agenda for a Global Europe [Reforming the Budget, Changing Europe]. The 2008/2009 EU Budget Review Draft 06-10-2009. Unofficial leaked text, at: http://www.people.ie/eu/eutax.pdf (last accessed 15 December 2011).

Cunha, A, Swinbank, A (2011). An Inside View of the CAP Reform Process: Explaining the MacSharry, Agenda 2000, and Fischler Reforms. Oxford, Oxford University Press. Daugbjerg, C, Swinbank, A (2009). Ideas, Institutions and Trade: The WTO and the Curious Role of EU Farm Policy in Trade Liberalization. Oxford, Oxford University Press.

Daugbjerg, C, Swinbank, A (2011). Explaining the ‘Health Check’ of the Common Agricultural Policy: budgetary politics, globalisation and paradigm change revisited. Policy Studies, 32 (2), 127-41. European Commission (2011a). Draft General budget of the European Union for the financial year 2012 Volume 3 Section III Commission. Brussels, EC.

European Commission (2011b). A Budget for Europe 2020. COM(2011)500. Brussels, EC. European Commission (2011c). Proposal for a Regulation of the European Parliament and of the Council establishing rules for direct payments to farmers under support schemes within the framework of the common agricultural policy. COM(2011)625/3. Brussels: EC. (one of a set of texts).

European Commission (2011d) Impact Assessment. Common Agricultural Policy towards 2020. Commission Staff Working Paper. SEC(2011)1153. Brussels: Brussels. European Commission (2011e). Indicative Figures on the Distribution of Aid, by Size- Class of Aid, Received in the Context of Direct Aid Paid to the Producers According to Council Regulation (EC) No 1782/2003 and Council Regulation (EC) No 73/2009 (Financial Year 2009. http://ec.europa.eu/agriculture/fin/directaid /2009/annex1_en.pdf (last accessed 5 January 2012).

European Parliament, Council and Commission (2006). Declaration on the Review of the Financial Framework attached to the Inter-institutional Agreement between the European Parliament, the Council and the Commission on budgetary discipline and sound financial management. Official Journal of the European Union. C139. 14 June.

Garzon, I (2006). Reforming the Common Agricultural Policy: History of a Paradigm Change. Houndmills: Palgrave Macmillan. Greer, A, Hind, T (2011). The Lisbon Treaty, agricultural decision-making and the reform of the CAP: a preliminary analysis of the nature and impact of ‘co-decision’. Paper presented at the Annual Conference of the Agricultural Economics Society, University of Warwick, 18-20 April.

Mathews, A (2011). Post-2013 EU Common Agricultural Policy, Trade and Development: A Review of Legislative Proposals. ICTSD Programme on Agricultural Trade and Sustainable Development, Issue Paper No.39. Geneva, International Centre for Trade and Sustainable Development.

Serger, S S (2001). Negotiating CAP Reform in the European Union–Agenda 2000. Report 2001: 4. Lund: Swedish Institute for Food and Agricultural Economics. Swinbank, A (2011a). Some Misconceptions about Requirements for the Post-2013 CAP’ In House of Commons Environment, Food and Rural Affairs Committee, The Common Agricultural Policy after 2013. Volume II. Fifth Report of Session 2010-11. HC 671-II. London: The Stationery Office, pp. 152-7. Swinbank, A (2011b). Fruit and vegetables, and the role they have played in determining the EU’s Aggregate Measurement of Support. The Estey Centre Journal of International Law and Trade Policy, 12 (2), 54-73.

Swinbank, A, Daugbjerg C (2006). The 2003 CAP Reform: Accommodating WTO Pressures. Comparative European Politics, 4 (1), 47-64. World Trade Organization (1994). WTO legal texts. http://www.wto.org/english/docs_e/legal_e /legal_e.htm (last accessed 12 January 2012). World Trade Organization (2011). Chairman’s Concluding Statement. Ministerial Conference Eighth Session Geneva, 15-17 December 2011. WT/MIN(11)/11. Geneva, WTO.

Download pdfFigures

Fig. 1. The EU’s Domestic Support Declarations to the WTO (ecu/? mil- lion) Source: EU’s declarations in the WTO’s document series G/AG/N/EEC/ Comment: Throughout the period shown amber box support has been declining and is well below the WTO limit (shown as the Amber Box Allowance). Blue box expenditure on partially cou- pled support such as area and headage payments has also been declining with expenditure on the SPS shifted to the een box. The lat- est declaration (for 2007/08) was made in January 2011. See Swinbank (2011b).